Across the UK, a growing number of businesses are refusing to accept cash payments, sparking a national debate over consumer rights and financial inclusion. From high street chains to restaurants and cafes, many establishments have gone completely cashless, arguing that digital payments are more efficient and secure.

However, critics argue that this shift is excluding millions of people, especially the elderly, low-income individuals, and those without access to digital banking.

With public frustration mounting, the question arises: Should businesses be legally required to accept cash?

Why Are Businesses Refusing Cash?

Many businesses have justified going cashless for several reasons, including:

✔️ Faster Transactions – Digital payments speed up checkout times, improving efficiency.

✔️ Reduced Risk of Theft – No cash means lower security risks for staff.

✔️ Lower Operational Costs – Businesses avoid handling and depositing cash, which can be time-consuming.

✔️ Hygiene Concerns – The COVID-19 pandemic accelerated the move away from physical money.

✔️ Encouraging Contactless Payments – With more people using smartphones and bank cards, businesses see cash as outdated.

Major UK businesses that have gone cashless include:

🔹 Gail’s Bakery – The popular chain with 150+ locations now refuses cash entirely.

🔹 Itsu – A leading fast-food chain that trialed a cashless system before making it permanent.

🔹 Zizzi – This restaurant chain only accepts card and contactless payments.

While cashless payments offer convenience, this trend has raised serious concerns about consumer choice and accessibility.

The Legal Debate: Are Businesses Required to Accept Cash?

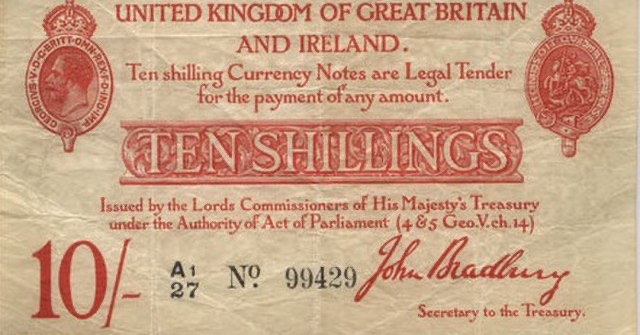

A common misconception is that cash is “legal tender” and must be accepted everywhere. However, under UK law, businesses have the right to choose which payment methods they accept.

📌 The Bank of England explains: “Legal tender means that coins and banknotes must be accepted for settling debts, but it does not mean businesses must accept cash in everyday transactions.

📌 The UK government has confirmed that there are no plans to force businesses to accept cash, leaving the decision up to individual companies.

This means a business can legally refuse cash payments—even though many believe this is unfair.

Public Outrage: Millions of Britons Rely on Cash

Despite the push for a cashless society, millions of people in the UK still depend on cash for daily transactions.

📊 Statistics on UK cash usage:

✔️ 1.5 million people use cash for all their purchases.

✔️ 71% of British adults believe businesses should be required to accept cash.

✔️ Cash withdrawals increased by 19% in 2023, proving many still prefer physical money.

Many Britons see cash as a fundamental right, and its decline is disproportionately affecting vulnerable groups:

🔴 Elderly Citizens – Many seniors are uncomfortable with digital banking or lack smartphones.

🔴 Low-Income Households – People on tight budgets prefer cash for better financial control.

🔴 Rural Communities – Many remote areas still lack reliable digital payment infrastructure.

🔴 People with Disabilities – Not everyone can use contactless or online banking systems.

With businesses refusing cash, these groups are being left behind in an increasingly digital world.

Government and Consumer Group Reactions

🔹 Consumer advocacy groups have called on the UK government to introduce laws protecting cash users.

🔹 Labour MP Kate Osborne described cash as a “fundamental right” that should be legally protected.

🔹 The Financial Conduct Authority (FCA) has been investigating the impact of a cashless society on disadvantaged communities.

In some European countries, governments have already taken action:

✅ Sweden – Initially moved toward a cashless society but reintroduced cash acceptance laws due to public backlash.

✅ Denmark – Businesses must still accept cash during specific hours.

✅ France – Companies must accept cash for purchases below a certain amount.

Many believe the UK should follow suit before it’s too late.

Potential Solutions: Balancing Digital Payments and Cash Accessibility

Rather than banning cashless payments, experts suggest a balanced approach:

1. Legal Requirement for Essential Services to Accept Cash

📌 Businesses like supermarkets, pharmacies, and public transport should be required to accept cash, ensuring basic needs can always be met.

2. Cash-Friendly Zones in High-Street Stores

📌 Large retailers could designate specific checkout lanes for cash transactions, similar to self-checkout systems.

3. Digital Training for Elderly and Low-Income Individuals

📌 Community programs could help people adapt to digital payments, ensuring no one is excluded.

4. Strengthening UK Cash Infrastructure

📌 Protect cash machines and bank branches, so people can still access physical money when needed.

These solutions would protect vulnerable groups while still allowing businesses to modernize payment systems.

Final Thoughts: Should Businesses Be Forced to Accept Cash?

The UK’s shift toward a cashless society has clear benefits, but it also comes with serious consequences for millions of Britons who still rely on physical money.

⚖️ Key Debate Points:

✅ Businesses argue cashless transactions are safer and more efficient.

✅ Consumers say refusing cash is discriminatory and excludes vulnerable people.

✅ The government has no legal requirement for businesses to accept cash, but pressure is growing for new regulations.

The big question remains: Should UK businesses be legally required to accept cash, or is digital-only the future?

FAQs

1. Can a UK business legally refuse cash?

Yes. Businesses can choose which payment methods they accept, including going fully cashless.

2. Why do some businesses no longer accept cash?

Reasons include faster transactions, lower security risks, and reduced operational costs.

3. How many people in the UK still rely on cash?

Over 1.5 million adults use cash for daily purchases, and many more prefer it for budgeting and security.

4. What can be done to protect cash users?

Potential solutions include requiring essential businesses to accept cash and protecting ATM access.

5. Will the UK government introduce laws to protect cash payments?

As of now, there are no legal plans, but pressure is increasing for new regulations.