Rachel Reeves faces mounting pressure as trade war devastates British businesses and threatens spending plans

Britain’s economy has suffered its sharpest monthly contraction since 2023, with GDP plummeting 0.3% in April as Donald Trump’s trade war sends shockwaves through UK exports in the worst monthly performance in over 18 months.

The devastating figures, released by the Office for National Statistics (ONS), were triple the 0.1% decline economists had predicted and mark a dramatic reversal after four consecutive months of growth.

In a crushing blow to Rachel Reeves’ economic credibility, British goods exports to the United States collapsed by an unprecedented £2 billion ($2.7 billion) in April – the largest monthly drop since records began in 1997.

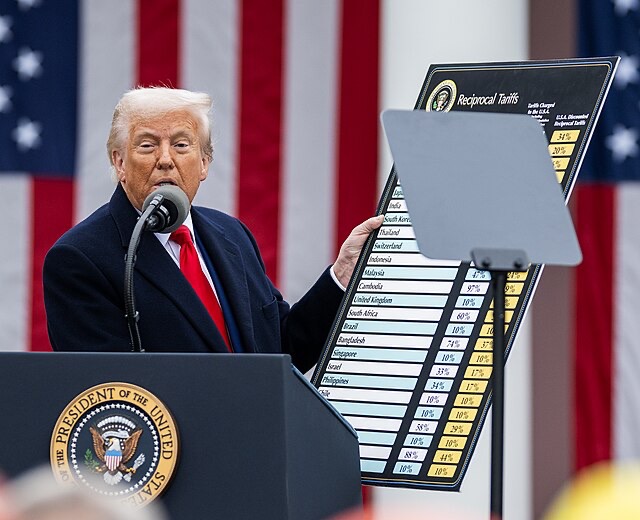

TRUMP TARIFFS DEVASTATE UK TRADE

After increasing for each of the four preceding months, April saw the largest monthly fall on record in goods exports to the United States with decreases seen across most types of goods, following the recent introduction of tariffs,” said Liz McKeown, the ONS’s director of economic statistics.

The figures lay bare the brutal impact of Trump’s protectionist policies on Britain’s economy, with the UK becoming the first major economy to suffer such a dramatic trade collapse despite having negotiated a supposed “special” trade deal with Washington.

Sterling immediately tumbled on the news, falling by a quarter of a cent against the dollar as markets digested the scale of the economic damage.

REEVES’ SPENDING PLANS IN TATTERS

The worse-than-expected GDP data represents a nightmare scenario for Chancellor Rachel Reeves, who is already walking a fiscal tightrope with her spending review plans hanging by what the IFS called a “gnat’s whisker.

With the economy now shrinking rather than growing, the Chancellor faces an impossible task of funding her ambitious spending commitments without resorting to further tax rises – something she pointedly refused to rule out in recent interviews.

The timing couldn’t be worse, coming just as Reeves unveiled massive spending promises including £39 billion for housing and £7 billion for new prisons.

BANK OF ENGLAND IN CRISIS MODE

The Bank of England had already warned that Trump’s tariffs would knock 0.3% off British output over three years, but April’s catastrophic figures suggest the damage is hitting far faster and harder than predicted.

Despite revising up its full-year growth forecast to 1% last month after a strong first quarter, the BoE now faces an impossible dilemma – with stubborn inflation preventing rate cuts while the economy tanks.

Though the door is probably closed on an interest rate cut next week, these downbeat figures increase the likelihood of a policy loosening in August,” economists warned.

MANUFACTURING AND INDUSTRY COLLAPSE

The economic pain was widespread across Britain’s key sectors:

- Industrial output fell 0.6%

- Manufacturing plunged 0.9%

- Only construction showed any growth, rising 0.9%

The services sector, Britain’s economic engine, also contracted, painting a bleak picture of an economy in broad retreat.

TRADE DEFICIT EXPLODES

Adding to the economic misery, Britain’s goods trade deficit ballooned to £23.2 billion in April from £19.9 billion in March – far worse than the £20.4 billion economists had expected.

The widening deficit reflects both collapsing exports to the US and potentially increased imports as British businesses scrambled to secure goods before further tariff escalations.

PROPERTY MARKET ADDS TO PAIN

A fall in real estate and legal activity after the end of a temporary tax break on house purchases contributed 0.2 percentage points of the 0.3 percentage point fall in output, the ONS revealed.

This double whammy of trade war impacts and domestic policy changes has created a perfect storm for the UK economy.

GLOBAL CONTEXT: UK SUFFERS ALONE

While the US economy also contracted 0.3% in the first quarter due to Trump’s trade wars, Britain appears to be suffering disproportionately from the global trade disruption.

So far, Britain is the only major economy to have agreed a trade deal with the U.S., which is intended to exempt it from Trump’s increased tariffs on aluminium and steel imports,” yet a 10% goods levy remains in place, making a mockery of post-Brexit trade promises.

WHAT HAPPENS NEXT?

With the economy now shrinking and exports in freefall, pressure is mounting on Reeves to either:

- Abandon her spending commitments

- Implement emergency tax rises

- Risk breaking her fiscal rules

The drag from U.S. trade policy has added to a range of domestic headwinds, including the significant tightening of fiscal policy and the lagged pass-through of past interest rate rises,” economists warned.

As businesses struggle with what the Liberal Democrats called the “jobs tax” from previous Budget measures, the addition of Trump’s trade war threatens to push the UK economy into a prolonged recession.

The Chancellor now faces the unenviable task of delivering growth to fund her spending plans while the economy heads in the opposite direction – a challenge that may prove impossible without further raids on taxpayers’ wallets.